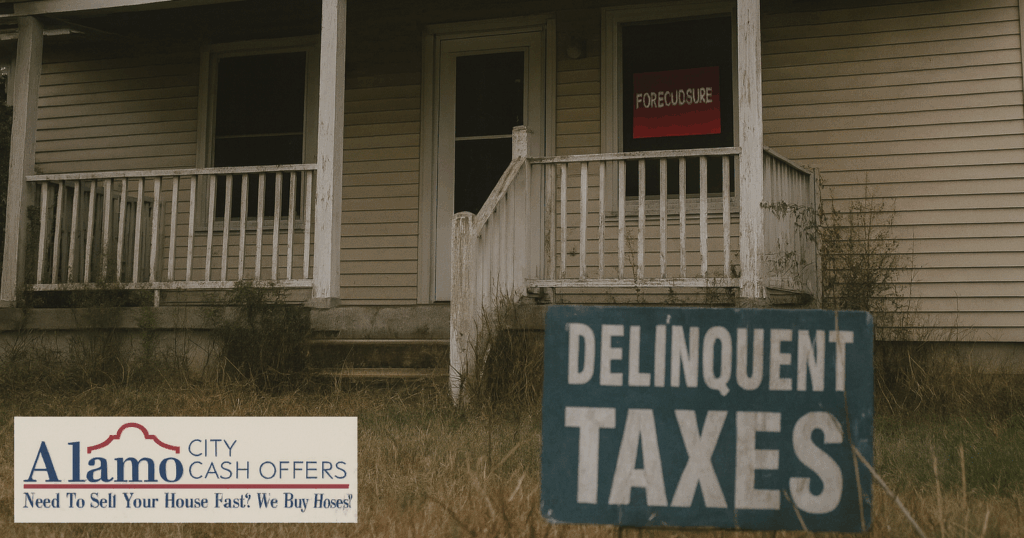

Falling behind on property taxes in San Antonio, Texas can feel overwhelming. Between penalties, interest, and the threat of foreclosure, many homeowners feel stuck with no good options. The good news? You do have options. One of the fastest and most effective ways to resolve delinquent taxes is to sell your San Antonio house quickly for cash.

Why Unpaid Property Taxes in San Antonio Are So Risky

When you fall behind on property taxes in Bexar County, the county can place a lien on your home. If left unpaid, that lien can lead to:

- Mounting penalties and interest that make it harder to catch up.

- Damage to your credit score, limiting future borrowing power.

- Foreclosure or a county tax sale, which means losing your home entirely.

Acting quickly gives you more control and prevents costly legal actions from taking place.

In Bexar County, property taxes are considered delinquent starting February 1, triggering a 6% penalty plus 1% interest per month until paid Bexar County+1. By July 1, penalties can rise to 12%, with a 15% collection fee added, making the total cost of delinquency severe San Antonio. Some estimates indicate that combined interest, penalties, and legal fees can balloon to over 40% of the original tax amount within a year afic.co+1.

Additionally, as soon as property taxes are assessed (by January 1), a tax lien is automatically placed on the home, which affects your ability to refinance or sell the property Bexar County. If left unpaid long enough, Bexar County may initiate foreclosure and auction the home sellmysahousefast.com.

Acting quickly gives you more control and can prevent foreclosure before it gets started.

How San Antonio Cash Home Buyers Can Help

Working with a cash home buyer in San Antonio can give you immediate relief from the burden of unpaid property taxes. Here’s why:

- Fast Closing – Many cash sales in San Antonio close in as little as 7–14 days. That speed can stop foreclosure before it happens.

- No Repairs Needed – Sell your San Antonio house as-is. You don’t have to fix anything or spend money on updates.

- Pay Off Back Taxes – A cash sale allows you to settle your delinquent taxes and often walk away with money left over.

- Simple Process – No lender delays, showings, or realtor commissions—just a straightforward cash offer.

When It Makes Sense to Sell for Cash in San Antonio

A fast cash sale may be the best choice if:

- You’ve received Bexar County delinquent tax notices.

- You’re worried about losing your home at auction.

- You can’t afford repairs, updates, or commissions.

- You want peace of mind and a fresh start in San Antonio’s competitive real estate market.

The Bottom Line

Being behind on property taxes in San Antonio doesn’t have to mean losing your home. Selling to a local San Antonio cash buyer gives you the ability to pay off your tax debt quickly, avoid foreclosure, and move forward without the stress of looming deadlines.

If you’re saying, “I need to sell my house fast in San Antonio because I’m behind on property taxes,” we can help.

👉 Call Alamo City Cash Offers today at 210.248.4819 for a no-obligation cash offer. We buy houses fast in San Antonio and surrounding areas—so you can get the relief you need and focus on your next chapter.